Overview

When you need to miss work due to an illness or accident, disability benefits can replace a percentage of your lost income, up to a maximum benefit.

Robert Half provides company-paid short-term disability (STD) and long-term disability (LTD) benefits if you’re a regular, full-time employee or part-time employee and you’re unable to work due to illness, injury or pregnancy.

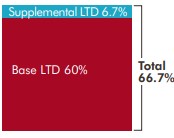

If you want additional LTD coverage, you may purchase supplemental LTD insurance.

Note: Your portion of the cost of medical and other benefit coverages is your responsibility even if you take a leave of absence, such as for a short-term disability. These benefit coverage costs will be deducted from any pay you may receive while on leave. For more detail, please refer to the Leave of Absence Manual and applicable policy documents on your internal company site or call Broadspire, Robert Half’s leave administrator, at 1.877.603.9687.

Short-Term Disability (STD) Insurance

Long-Term Disability (LTD) Insurance

Click for Footnotes

1Benefits-eligible earnings are your average base pay plus your bonus and commissions over a 12-month look-back period starting from October and ending in September. If you’re a new employee, your benefits-eligible earnings are your base pay.

2 Disabilities that begin in the first 12 months of coverage and are due to a pre-existing condition will not be payable under the plan. A condition will be considered pre-existing if you received a physician’s advice or treatment within three months prior to your effective date of coverage. See your plan booklet for full details.